Summary

Key Debt Metrics

| 31 December 2024 | |||

|---|---|---|---|

| Transurban Group | Corporate | Non- recourse | |

| Weighted average maturity (years)1,2 | 6.6 yrs | 5.3 yrs | 7.6 yrs3 |

| Weighted average cost of AUD debt1,2 | 4.4% | 4.7% | 4.2% |

| Weighted average cost of USD debt1,2 | 3.5% | 4.1% | 3.3% |

| Weighted average cost of CAD debt1,2 | 4.9% | 4.6% | 6.3% |

| Hedged1,2,5 | 98.2% | 99.1% | 97.6% |

| Gearing (proportional debt to enterprise value)1,2,6 | 37.5% | ||

| FFO/Debt (S&P) | 11.2% | ||

| Corporate senior interest cover ratio (historical ratio for 12 months) | 3.9x | ||

| Corporate debt rating (S&P / Moody's / Fitch) | BBB+ / Baa1 / A- | ||

| 30 June 2024 | |||

|---|---|---|---|

| Transurban Group | Corporate | Non- recourse | |

| Weighted average maturity (years)1,2 | 6.7 yrs | 5.4 yrs | 7.8 yrs4 |

| Weighted average cost of AUD debt1,2 | 4.5% | 4.8% | 4.3% |

| Weighted average cost of USD debt1,2 | 3.6% | 4.1% | 3.3% |

| Weighted average cost of CAD debt1,2 | 4.9% | 4.6% | 6.3% |

| Hedged1,2,5 | 88.2% | 85.5% | 90.4% |

| Gearing (proportional debt to enterprise value)1,2,6 | 39.9% | ||

| FFO/Debt (S&P) | 11.5% | ||

| Corporate senior interest cover ratio (historical ratio for 12 months) | 4.2x | ||

| Corporate debt rating (S&P / Moody's / Fitch) | BBB+ / Baa1 / A- | ||

1. CAD, CHF, EUR, NOK and USD debt is converted at the hedged rate where cross currency swaps are in place. USD debt is converted at the spot exchange rate (0.6630 at 30 June 2024 and 0.6217 at 31 December 2024) where no cross currency swaps are in place. CAD debt is converted at the spot exchange rate (0.9093 at 30 June 2024 and 0.8920 at 31 December 2024) where no cross currency swaps are in place.

2. Calculated using proportional drawn debt exclusive of letters of credit.

3. The weighted average maturity of Australian non-recourse debt is 5.9 years at 31 December 2024.

4. The weighted average maturity of Australian non-recourse debt is 6.2 years at 30 June 2024

5. Hedged percentage comprises fixed rate debt and floating rate debt that has been hedged and is a weighted average of total proportional drawn debt, exclusive of issued letters of credit.

6. Calculated using proportional debt to enterprise value, exclusive of issued letters of credit. Security price was $12.40 at 30 June 2024 and $13.39 at 31 December 2024 with 3,092 million securities on issue at 30 June 2024 and 3,104 million securities on issue at 31 December 2024.

Debt Position Summary

As at 31 December 2024

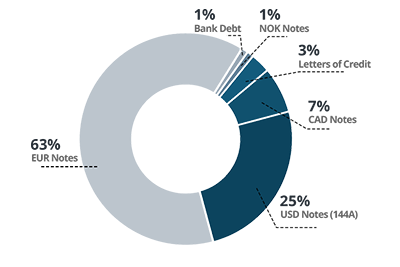

| CORPORATE1 | |

|---|---|

| |

| Total debt2 | A$11.2B |

| Average tenor3 | 5.3 years |

| Average AUD interest rate4 | 4.7% |

| Average USD interest rate4 | 4.1% |

| Average CAD interest rate4 | 4.6% |

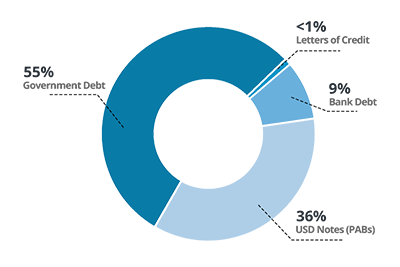

| AUSTRALIA NON-RECOURSE1 | |

|---|---|

| |

| Total debt2 | A$21.3B |

| Average tenor3 | 5.9 years |

| Average AUD interest rate4 | 4.2% |

| Average USD interest rate4 | N/A |

| Average CAD interest rate4 | N/A |

| NORTH AMERICA NON-RECOURSE1 | |

|---|---|

| |

| Total debt2 | A$4.3B |

| Average tenor3 | 17.2 years |

| Average AUD interest rate4 | N/A |

| Average USD interest rate4 | 3.3% |

| Average CAD interest rate4 | 6.3% |

1. CAD, CHF, EUR, NOK and USD debt converted at the hedged rate where cross currency swaps are in place. USD debt is converted at the spot exchange rate (0.6217 at 31 December 2024) where no cross currency swaps are in place. CAD debt is converted at the spot exchange rate (0.8920 at 31 December 2024) where no cross currency swaps are in place.

2. Represents drawn amounts on a 100% interest basis, including separate letters of credit issued.

3. Calculated using proportional drawn debt.

4. Proportional drawn debt exclusive of issued letters of credit.

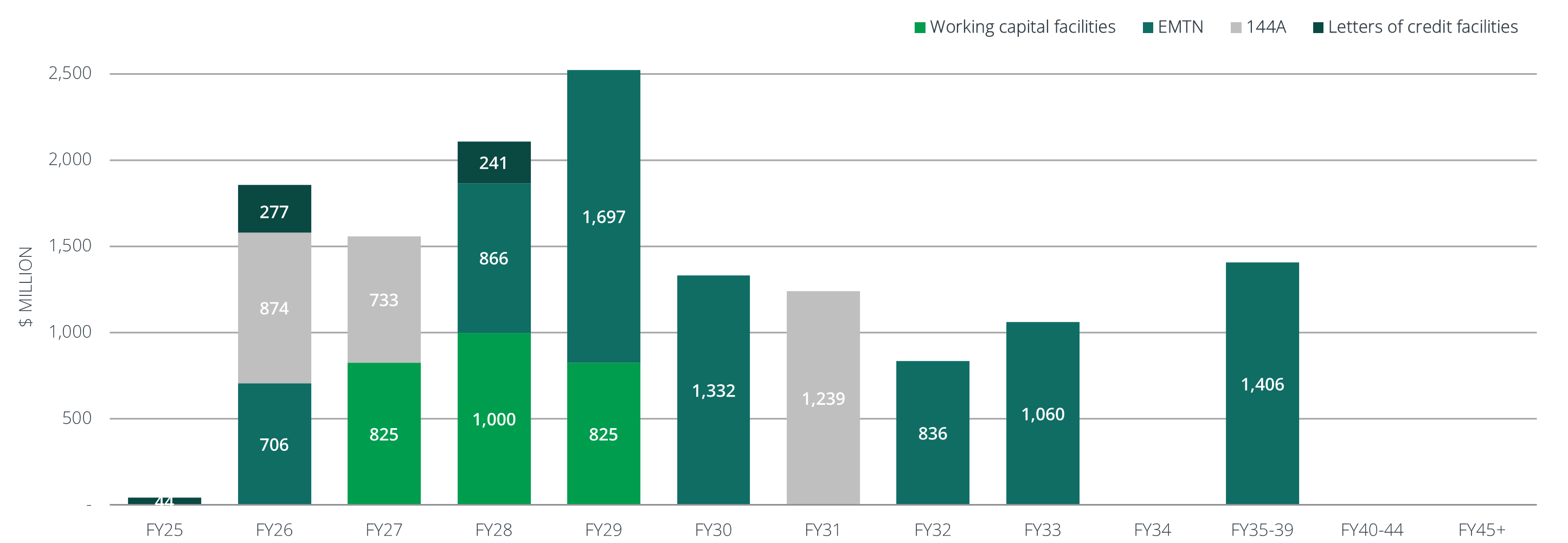

Debt Maturity Profile

Corporate (as at 31 December 2024)1,2

1. The full value of debt facilities is shown. Debt is shown in the financial year in which it matures.

2. Debt values are shown in AUD as at 31 December 2024. CAD, EUR, NOK and USD debt converted at the hedged rate where cross currency swaps are in place. USD debt is converted at the spot exchange rate (0.6217 at 31 December 2024) where no cross currency swaps are in place. CAD debt is converted at the spot exchange rate (0.8920 at 31 December 2024) where no cross currency swaps are in place.

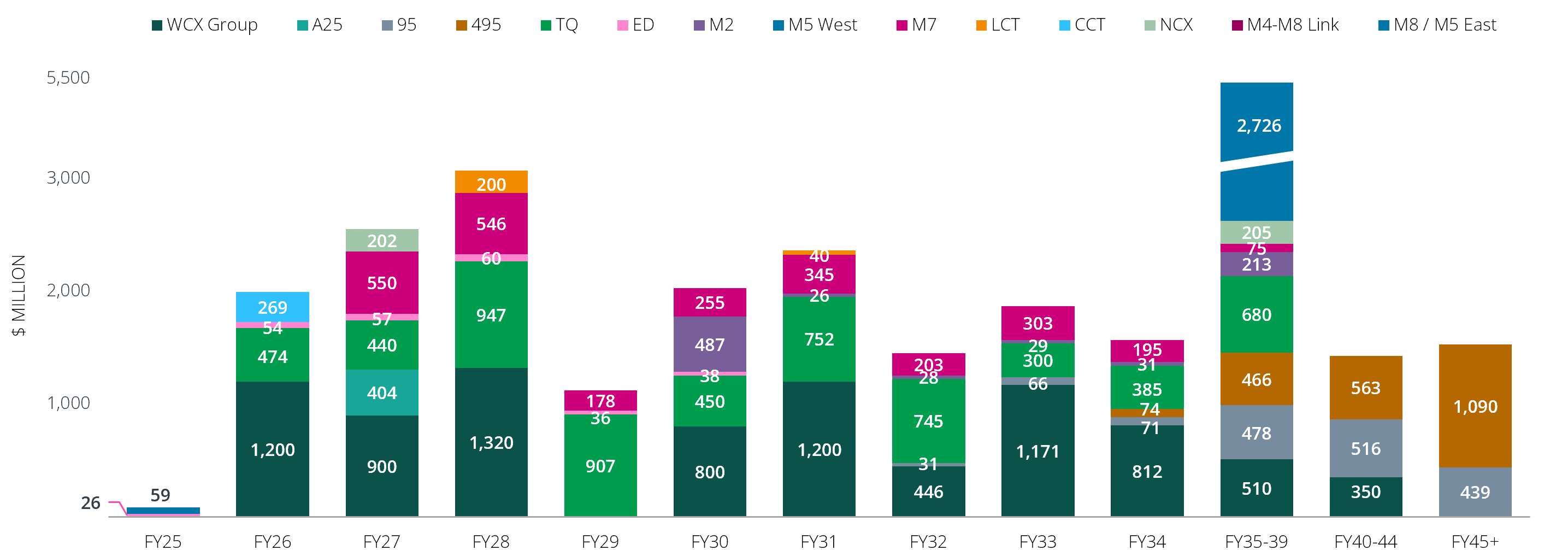

Non-Recourse (as at 31 December 2024)1,2

1. The full value of debt facilities is shown, not Transurban’s share, as this is the value of debt for refinancing purposes. Debt is shown in the financial year in which it matures. Annual maturities or amortisation repayments less than $25 million are not annotated on the graph above.

2. Debt values are shown in AUD as at 31 December 2024. CAD, CHF and USD debt converted at the hedged rate where cross currency swaps are in place. USD debt is converted at the spot exchange rate (0.6217 at 31 December 2024) where no cross currency swaps are in place. CAD debt is converted at the spot exchange rate (0.8920 at 31 December 2024) where no cross currency swaps are in place.